XM’s analysts in India take a close look at gold, which has been rallying since early November, repeatedly meeting strong support near $1615. This may be due to sliding US bond yields, as well as a dollar weakened by expectations that the Fed may be nearing the end of its tightening crusade. Also adding to the support are increasing fears of a US recession.

How gold lost its safe-haven status

As a safe-have asset, gold attracts investors when markets are turbulent. In August 2020, the precious metal hit a record high, as investors sought shelter in gold due to the outbreak of the coronavirus pandemic. It came close to retesting that record in early March 2022, due to Russia’s invasion of Ukraine.

However, it was all downhill from there. Market participants became nervous that the world could slip into a recession, while inflation spiraled out of control due to supply shortages caused by the pandemic and the war. This rang alarm bells, forcing central banks around the globe to raise interest rates aggressively.

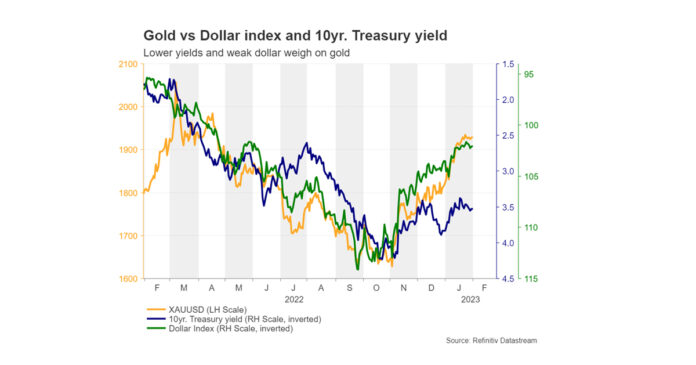

As rates and bond yields rose quickly worldwide, the non-yielding yellow metal lost its shine, and the title of ‘safe-haven’ passed to the US dollar. With the Fed hiking more aggressively than other major central banks, the greenback became the only safe-haven currency also offering relatively high yields.

Fed pivot bets fuel gold’s engines

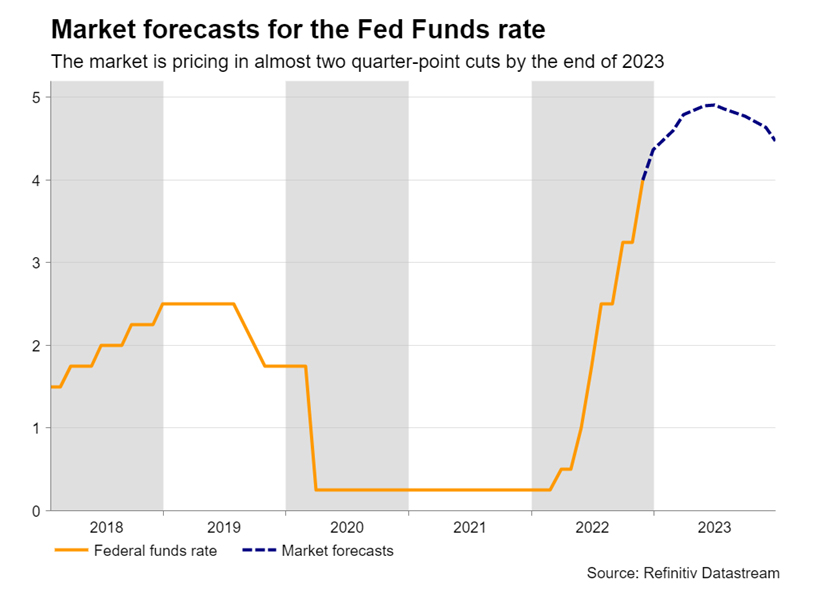

The narrative changed towards the end of 2022, likely helping gold. The Fed slowed its rate path to 25bps worth of increases and, although policymakers repeatedly signaled interest rates would rise above 5% and stay there for a prolonged period, investors saw a terminal rate within the 4.75-5.00% range and priced-in nearly 50bps worth of rate cuts towards the end of the year.

It seems investors are relying on economic data rather than the Fed’s communication. The steady cooling of US inflation and the deterioration in data relating to economic growth may have been the main reasons behind investors’ pivot bets, as tighter monetary policy could hurt the economy further. After all, the full effect of the delivered rate increments may not have been reflected in the data yet.

If investors continue to anticipate rate reductions towards the end of the year, Treasury yields and the US dollar may stay under pressure, allowing gold to drift further north. Also, should the outlook continue to darken, intensifying recession fears could prove supportive, as the metal now looks more than ready to reclaim its safe-haven crown.

Indian gold consumption falls as prices hit record highs

India is among the world’s top gold importers, so it’s worth taking a close look at developments surrounding the local market. In 2022, India’s gold consumption fell 3% y/y, as prices climbed close to record highs, bolstered by the government’s decision in July to hike the import duty on gold to 15%.

Falling demand and consumption in India is a negative variable on global gold prices, but surging discounts by jewelers and bullion dealers in the country may offset the impact. Consumption could improve during the first quarter of 2023 due to increasing rural demand, where two thirds of India’s gold demand comes from, and where jewelry is a traditional store of wealth.

What would it take for gold to reverse?

For gold to reverse, the Fed may need to stick to its guns and raise interest rates above 5%. This could prompt investors to reconsider their rate-cut bets. Should officials refrain thereafter, market participants may take such bets off the table. This readjustment might result in a rebound in Treasury yields and the US dollar, and thereby a slide in gold.

About XM

XM is a global trading and investment firm, with over 5 million clients, across 190+ countries. Holding multiple international licenses, XM offers competitive services for retail traders, investors, and affiliates.

By opening an XM account, traders can access over 1,000 instruments on more than 10 platforms, including the XM app. The award-winning broker is known for low-cost accounts, exciting promotions, excellent support, and outstanding live education.

Risk warning:

Our services involve a significant risk and can result in the loss of your invested capital. *T&Cs apply.